-

SERVICES

-

Branded app

Our white label streaming service if you need a front-end and backend ready-to-go.

Branded app

-

Catalogue Delivery

Music catalog ingestion & delivery including metadata, assets and rights management.

Catalogue Delivery

-

Streaming service APIs

A set of documented APIs to help you implement streaming features in your existing platform.

Streaming service APIs

-

Playlisting tool

Music Curation solution to easily create playlists that comply with your licensing agreements.

Playlisting tool

-

AutomixIQ

SDK that enhances music streaming experiences with seamless song transitions, akin to a DJ mix

AutomixIQ

-

Social Radio

SDK that adds a social experience to music apps with live broadcasting and real-time interaction.

Social Radio

-

Music Licensing

A consultancy service to help you navigate the complex music licensing space.

Music Licensing

-

Integrations

A curated ecosystem of third-party technologies to activate more functionality.

Integrations

How do we help with your streaming project...

How do we help with your streaming project...

Features

Features

-

-

INDUSTRIES

-

Fitness & Wellbeing

A playlisting tool for instructors to incorporate music into digital classes

Fitness & Wellbeing

-

Telcos & Mobile Operators

Bundle your own entertainment app to acquire and retain customers

Telcos & Mobile Operators

-

Aviation & Transport

Music delivery and curation tools for inflight entertainment (IFE)

Aviation & Transport

-

Gaming

Enhance your user experience safely with music and clear reporting

Gaming

-

Radio Networks & Broadcasters

AI and interactivity tools to engage, monetise, and optimise programming

Radio Networks & Broadcasters

Powering music experiences across industries

Powering music experiences across industries

-

-

TECHNOLOGY

Overview

Overview

What makes us different in the B2B music tech market is our innovative backend technology for streaming services. Our next generation cloud based infrastructure allow streaming services to scale on-demand and we can ingest millions of tracks in a matter of time without performance issues.

- CLIENTS

-

ABOUT

About

About

We are your 360º B2B music streaming technology partner that helps to quickly launch and grow streaming services around the world. The company develops simple, fast and engaging music, audio and video streaming platforms for enterprises and start-ups.

-

RESOURCES

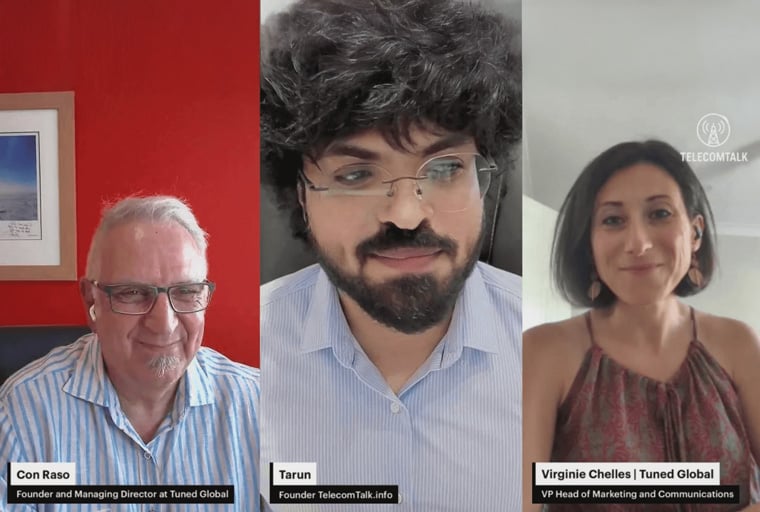

VLOG - Stream by Stream

VLOG - Stream by Stream

We interview music tech expert to help you in your streaming journey

BLOG - #Power of music

BLOG - #Power of music

Our blog where we share our views about trends in music and streaming tech